Tel

0731-88915528

Position:Home > About Huanyu > News & Updates

Zhitone Financial APP learned that on December 7, the Shanghai Stock Exchange announced the results of the 105th review meeting of the STAR Market Listing Committee in 2022. Hunan Aerospace Huanyu Communication Technology Co., Ltd. (referred to as "Aerospace Huanyu") passed its initial public offering review. Caixin Securities served as its sponsor, with plans to raise RMB 500 million.

In the aerospace process equipment segment, the company primarily serves subsidiaries of AVIC, COMAC, AECC, CASIC, and CASC. It undertakes the development, maintenance, and services of metal/composite material component molding equipment, assembly jigs, automated composite part production lines, section/whole-aircraft assembly lines, and non-standard equipment. The company has delivered process equipment for ARJ21, C919, and CR929 commercial aircraft, military aircraft, UAVs, and target drones (covering fuselages, wings, engine blades, horizontal/vertical tails), as well as equipment for satellite antenna reflectors and rocket fairings.

During the reporting period, Q4 revenue accounted for 79.91%, 77.13%, and 70.24% of annual revenue, respectively. Due to pronounced seasonal characteristics in revenue, the company faces significant seasonal fluctuation risks.

Additionally, Aerospace Huanyu faces risks associated with "shipment before contract signing." Some orders require urgent production and delivery, leading to scenarios where products are shipped before formal contracts are executed. During the reporting period, such pre-shipment revenue accounted for 82.59%, 64.00%, 53.36%, and 71.12% of total main business revenue across product categories. Although no cancellations or returns occurred historically, the highly customized nature of delivered products/services (which cannot be resold) may weaken the company's pricing negotiation position, posing risks to expected profitability.

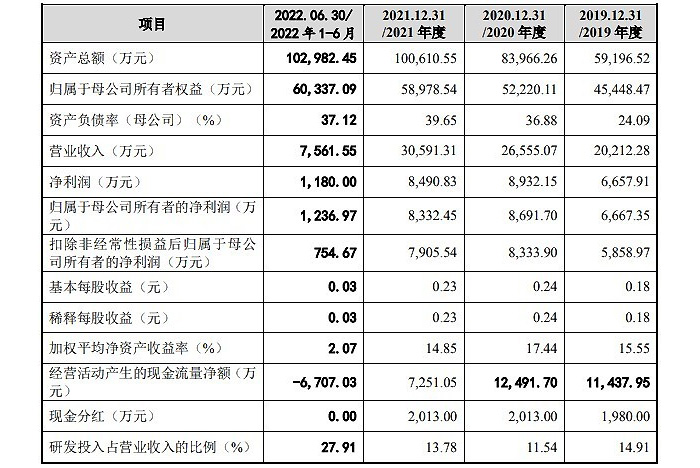

Financially, during the fiscal years 2019, 2020, and 2021, the company achieved operating revenues of approximately RMB 202 million, RMB 266 million, and RMB 306 million, respectively. Net profits were approximately RMB 66.5791 million, RMB 89.3215 million, and RMB 84.9083 million, respectively.